This Dividend Stock Yields Nearly 8% and Trades at Depressed Valuations: Time to Buy?

Pfizer (PFE) investors are bound to be disappointed with the stock’s price action.

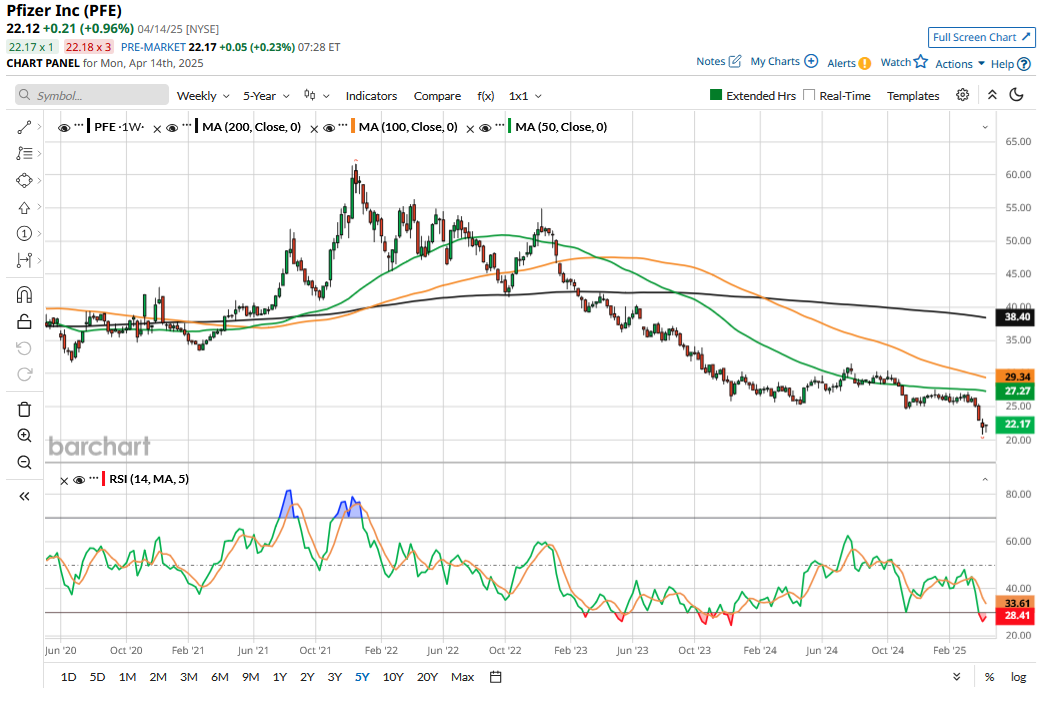

With a year-to-date loss of 16.7% as of April 15, the stock is underperforming the S&P 500 Index ($SPX) by a good margin. The global pharmaceutical giant’s underperformance is not limited to 2025. The stock lost 41% in 2023 and 2% in 2024, even as the broader markets delivered double-digit returns in both years.

PFE shares also lost 10% in 2022 and now trade significantly below their 2020 and 2021 peaks. Back then, sales of its COVID-19 vaccine helped lift revenue and profits. However, Pfizer’s revenues from its COVID-19 portfolio have tumbled as global demand now is much lower than during the pandemic.

Meanwhile, amid the steep fall in its stock price, Pfizer now boasts a dividend of around 7.8%. This is quite robust and ranks it among the top dividend stocks of the S&P 500 Index. On top of that, the stock trades at single-digit price-earnings (P/E) multiple. Does that make PFE stock a buy? Let’s explore.

Pfizer Stock: Undervalued or a Value Trap?

Pfizer forecast 2025 revenues to be between $61 billion and $64 billion. The company expects its adjusted diluted earnings per share (EPS) to be between $2.8 and $3.00. Given where the stock trades today, its 2025 P/E based on the top end of its guidance comes to around 7.4x. Moreover, the P/E-to-growth (PEG) multiple is just 0.53x, which signals undervaluation. While such valuations – which are way below what Pfizer has historically traded at – sound tempting, they should be taken in perspective.

Firstly, while President Donald Trump spared pharmaceutical imports from his “reciprocal tariffs,” the administration has begun a probe into the “national security” implications of pharma and semiconductor imports which could eventually lead to separate tariffs. Tariff uncertainty has been a hanging sword for many U.S. companies, putting a lid on their price action.

On a company-specific level, Pfizer is still battling falling revenues from its COVID-19 portfolio. Last year, the sales of these products totaled around $11 billion, of which $5.7 billion was for Paxlovid and $5.4 billion for the Comirnaty vaccine. Pfizer’s revenues from the COVID-19 portfolio fell by over 11% year-over-year last year led by a 53% fall in vaccine sales.

Moreover, several of Pfizer’s patents are set to expire over the next five years which is making markets apprehensive. While Pfizer is working on several new products, it hasn’t had any major breakthroughs yet. In a blow to its ambitions to develop an anti-obesity drug, the company has discontinued the development of the experimental weight-loss pill danuglipron after potential drug-induced liver injury in a trial patient.

Overall, while Pfizer seems to trade at mouthwatering valuations, this is due to the multiple challenges that the company is facing.

PFE Stock Forecast

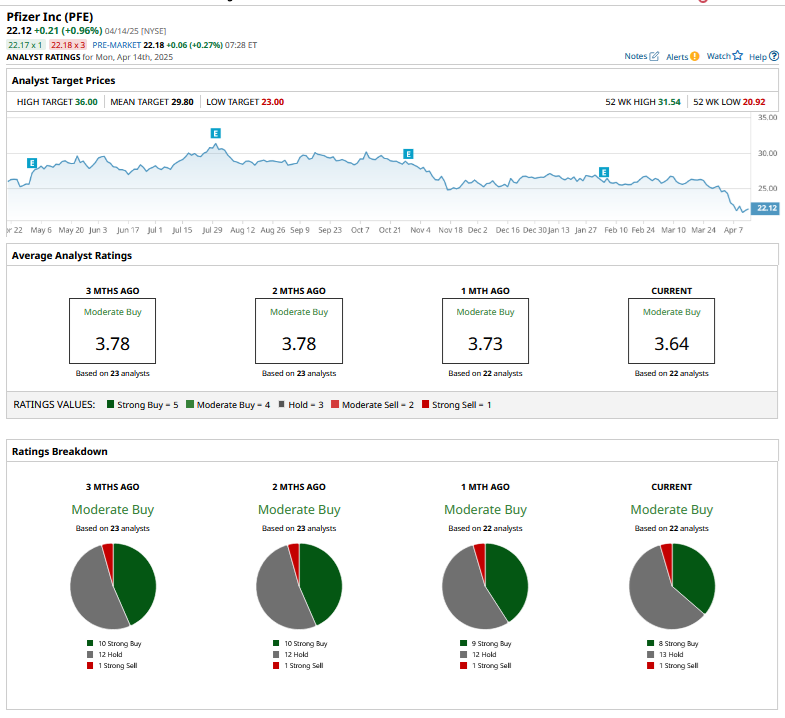

Amid the recent selloff, Pfizer has fallen even below its Street-low target price of $23, while its mean target price of $29.80 is 30% higher than current prices as of April 15. PFE has a consensus rating of “Moderate Buy” from the 22 analysts actively covering the stock.

Meanwhile, while Pfizer’s recent price action has been disappointing, the downside looks limited from these levels given the current valuations.

During the Q4 2024 earnings call, Pfizer CEO Albert Bourla touted the multi-year contracts for its COVID-19 portfolio and stressed, “We are confident that our COVID-19 portfolio will continue to be a predictable and durable contributor to our business.”

Pfizer has also doubled down on cost cuts which helped it expand its gross margins to 74% last year. Over the long-term, oncology could be a key growth driver for Pfizer and the company is expanding its portfolio of anti-cancer drugs with Seagen – which it acquired in 2023 – a key part of that strategy. Management expects Seagen to add $10 billion in “risk-adjusted” sales by the end of this decade.

Overall, with a dividend yield of almost 8%, Pfizer could reward patient investors with decent double-digit total returns over the next few years as the stock’s valuations revert toward more normalized levels.

On the date of publication, Mohit Oberoi had a position in: PFE . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.